Indianapolis has been gaining attention as a hotspot for real estate investors, offering a blend of affordability and steady rental demand. Whether you’re a seasoned investor or new to the market, evaluating a rental property is a crucial step to ensure a sound investment. Here’s a simple guide to help you navigate the process. Also give insights on how bringing on the right team members can make all the difference.

1. Analyze the Local Market

Start by understanding the real estate trends in Indianapolis. Research neighborhoods, rental demand, and average rental rates. Look for areas with strong employment opportunities, good schools, and amenities that attract renters. A knowledgeable property manager can provide valuable insights into neighborhood trends and tenant demographics, helping you choose the right location.

2. Inspect the Property

Thoroughly assess the condition of the property. Pay attention to the structure, roofing, plumbing, and electrical systems. Identify any potential repair or renovation costs. This step is critical to avoid unexpected expenses later. Property Inspectors have the expertise to identify red flags and ensure you’re fully informed about the property’s condition. Once you sign the purchase agreement, be sure it is contingent on inspection and financing. A quality inspection report can give an investor negotiation leverage.

3. Calculate Potential Returns

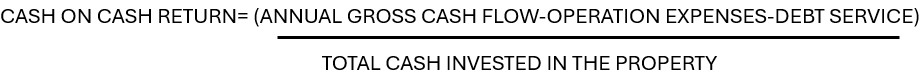

Evaluate the financial aspects of the investment. Determine the purchase price, expected rental income, and operating costs, including property taxes, insurance, maintenance, and management fees. Use metrics like cash-on-cash return and cap rate(for commercial property) to assess profitability. Partnering with an experienced property manager helps you accurately estimate rental income and operating costs for better decision-making.

4. Evaluate Tenant Potential

The type of tenants your property attracts can significantly impact your investment. Consider factors like tenant income, background, and rental history. Effective tenant screening ensures you find reliable renters who pay on time and care for the property. Also, you must understand the location will attract a certain level of tenant. More affluent tenants prefer amenities and close shopping, and more cost-conscious tenants appreciate value such as storage and wholesale or value-priced grocery stores.

5. Ensure Legal Compliance

Rental properties must comply with local regulations, including zoning laws, safety standards, and landlord-tenant laws. Staying up-to-date with these requirements ensures your property meets legal standards and helps you avoid potential fines or legal issues. A good property manager can help navigate these issues.

6. Plan for Long-Term Management

Successful rental properties require ongoing management. From marketing vacancies to handling repairs and rent collection, property management is time-intensive. With the right management team, you can rest easy knowing your property is in expert hands, allowing you to focus on growing your portfolio.